4 minutes of readingBombayFebruary 3, 2026 06:01 am IST

Noting a sharp rise in “large group unconditional cash transfer schemes” across states, the 16th Finance Commission warned that a growing dependence on cash handouts could destabilize state finances. A periodic and rigorous review of subsidies is requested, a rationalization of the beneficiary base and clear termination or exit clauses.

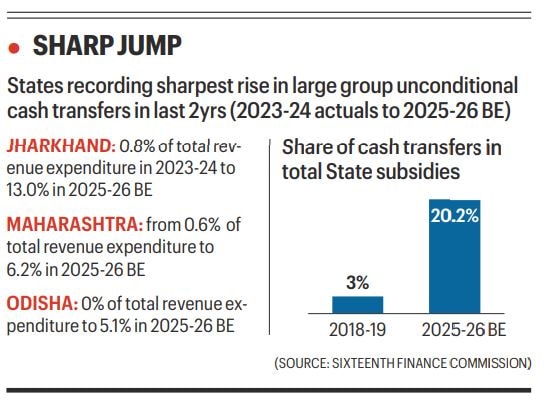

The Commission singled out BJP-ruled Maharashtra and Odisha and opposition-ruled Jharkhand among the states that have seen the steepest rise in such spending in the last two years. In its report for the period 2026-2031, tabled in Parliament on Sunday, the Commission, chaired by economist Arvind Panagariya, said this trend has significantly reshaped the way states spend on subsidies. In 21 states, large cash transfer schemes (which involve direct payments to beneficiaries without performance benchmarks or conditions on how the money is used) now account for more than a fifth or 20.2% of total subsidy spending in 2025-26. budget Estimates, well up from just 3% in 2018-19.

At present, the largest such schemes are Maharashtra’s Majhi Ladki Bahin Yojana (Rs 1,500 per month for eligible women), Karnataka’s Gruha Lakshmi (Rs 2,000 per month for women heads of households) and West Bengal’s Lakshmir Bhandar (Rs 1,200 per month for SC/ST women and Rs 1,000 for general category women), the report said.

The review process, the Commission said, should ensure that benefits reach the most vulnerable and help reduce, and eventually eliminate, revenue shortfalls. “It is necessary to introduce sunset clauses, especially in schemes that provide subsidies for non-deserving private goods and unconditional general transfers,” he said, recommending that governments establish formal mechanisms to periodically review such subsidies. It also signaled a shift within the universe of unconditional cash transfers. While social security for pensioners and farmers accounted for the majority (or 84%) of such spending in 2018-19, large cash transfer schemes like the three above now account for almost half (or 47.4%) of all unconditional transfers, overtaking both categories in 2025-26.

The Commission attributed this shift in part to improvements in delivery systems, noting that while the Jan Dhan-Aadhaar-Mobile (or JAM) payment trinity has reduced leakage and improved efficiency, it has also made cash for large population groups a preferred welfare instrument for states.

Such transfers recorded a growth trend of 53.6% between 2018-19 and 2025-26, and the total outlay is projected to reach Rs 1.96 lakh crore in 2025-26. However, the Commission notes that much of the expansion occurred after 2023-24, indicating a recent acceleration rather than a gradual increase.

For example, Maharashtra’s spending on cash transfers to large groups jumped from 0.6% of total revenue expenditure in 2023-24 to 6.2% in 2025-26 (Budget Estimates). In Jharkhand, such expenditure increased from 0.8% to 13% during the same period and Odisha also recorded a sharp increase, from zero to 5.1% during the same period.

Story continues below this ad.

“If major States continue to allocate increasing proportions of their revenue expenditures to unconditional cash transfers to large groups, they will not only impose a significant burden on State budgets but will also destabilize their finances in the long run,” the report states immediately after referring to the increase in cash transfer spending of Maharashtra and Odisha in the last two years. In Maharashtra, the BJP-led Maha Yuti government Eknath Shinde The Sena and Ajit Pawar-led NCP had introduced Majhi Ladki Bahin Yojana in July 2024. As part of the scheme, a monthly facility of Rs 1,500 is given to eligible women. As of January, there were 2.3 crore beneficiaries of the scheme.

The scheme was introduced after MahaYuti received a defeat in the 2024 Lok Sabha polls. BJP leaders and their allies credit the scheme for victory in the Assembly elections later in the year. The Commission has warned that many subsidy schemes, particularly large unconditional cash transfers, have expanded to “large and untargeted beneficiary bases”, making them inefficient and fiscally costly. Such plans, he said, “not only impose a large fiscal burden” but also “crowd out capital spending and other critical expenses related to the provision of basic services, such as education and health.”

It warned that financing these plans through off-budget loans, guarantees or revenue allocations is “fiscally reckless” as it creates opacity in public accounts, and said such practices should be suspended and actively discouraged.

Stay up to date with the latest – Click here to follow us on Instagram

© The Indian Express Pvt Ltd